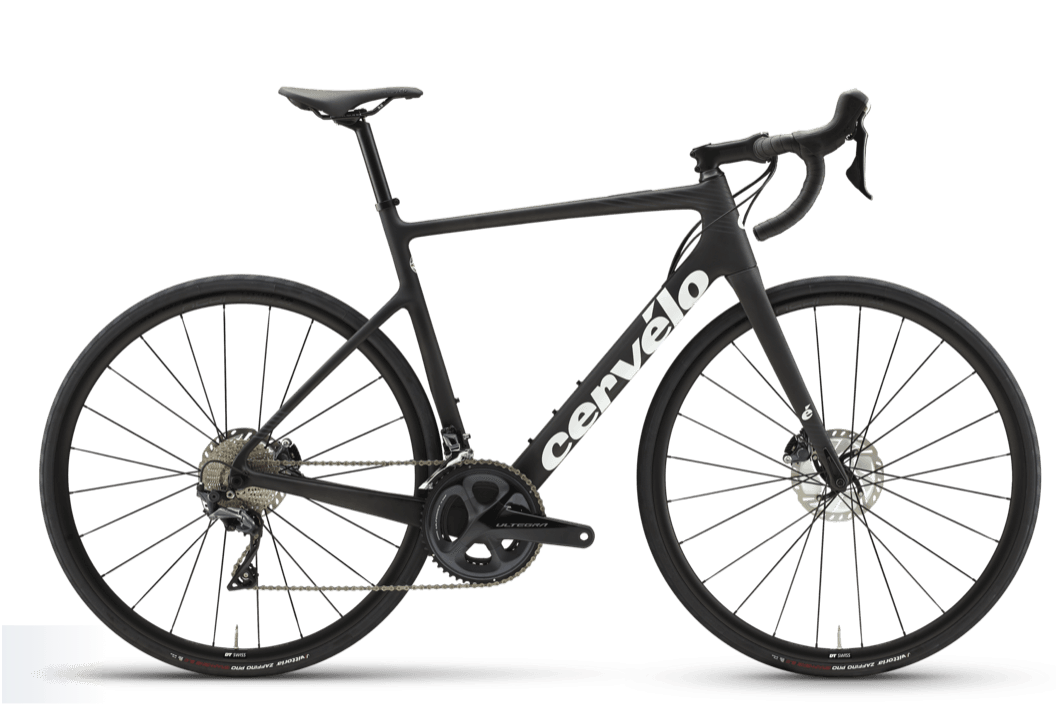

Cervélo Caledonia

Road bike € 3.399

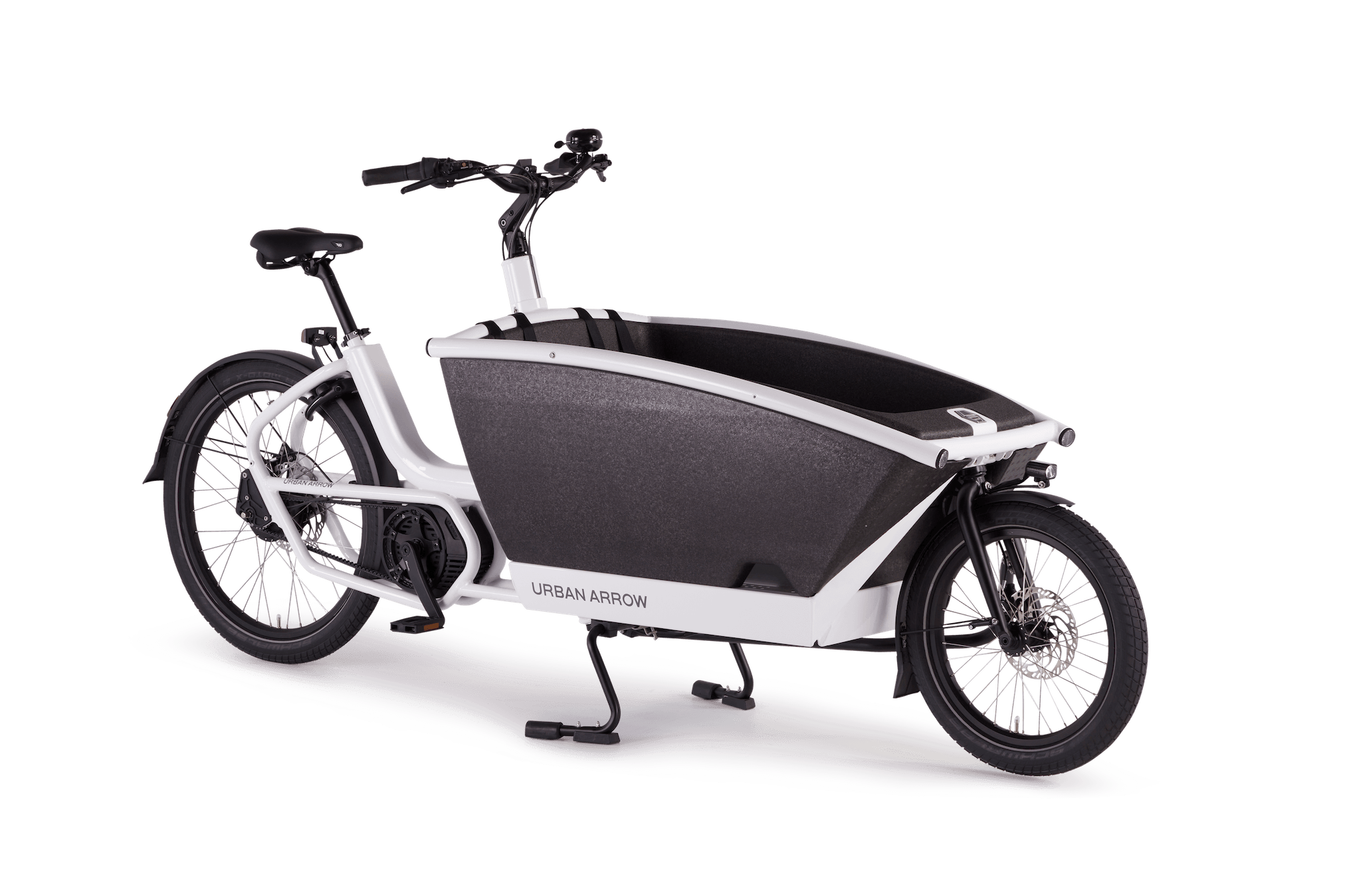

Urban Arrow Family Cargo Line

Electric Cargo Bike € 6.690

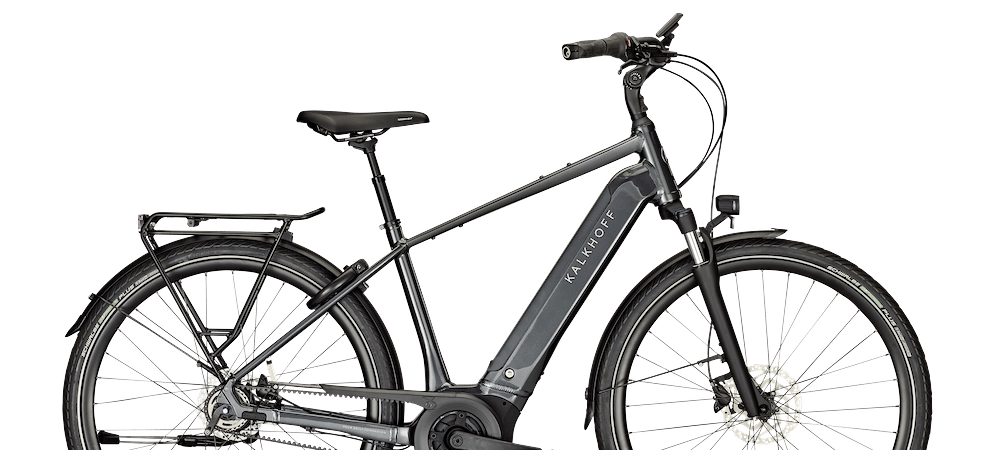

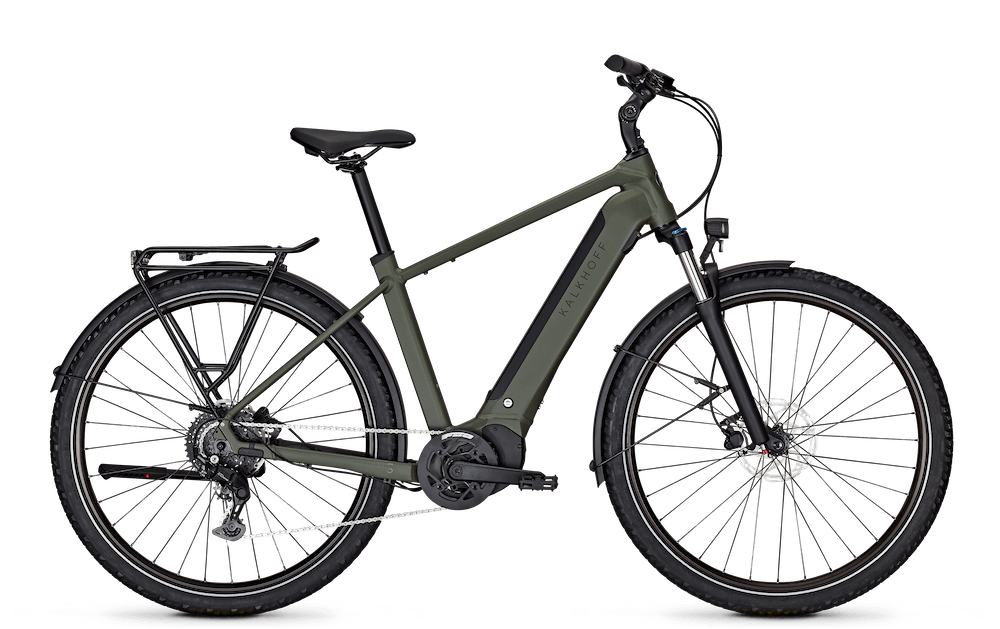

Kalkhoff Entice 5 Move+

E-Bike € 4.499

Monthly costs

€ 63,52

You save compared to purchase

€ 2.001

At Lease a Bike, we want to offer our customers the best possible customer service when it comes to company bikes. Your personal contact person is available by phone, email or live chat Monday to Friday (weekdays) from 8 am to 6 pm.

Carefree leasing thanks to our all-round protection packages. You choose from various options for theft & damage protection (incl. free Europe-wide mobility guarantee), inspection and wear and tear and configure your all-round protection to suit your requirements.

Lease your company bike for a fixed monthly instalment and benefit from savings of up to 40% compared to buying a bike. Use the bike leasing calculator now and calculate your savings.

Everything is possible! Lease a Bike offers the largest selection of products and brands for your company bike: whether city bike, e-bike, racing bike or e-mountain bike - you are guaranteed to find what you are looking for at our more than 6,700 specialist bike shops.

Cycling is good for your health and your wallet. A company bike can be up to 40 % cheaper than buying one. The salary conversion reduces the taxable gross salary and thus also the social security contributions and taxes. With our calculator you can easily see how much you can save. Please note that the leasing rate shown is a non-binding calculation example.

Loading calculator...

Interested in getting a company bike? Talk to your employer. Our team will be happy to support you.

After your employer has successfully completed the registration process, you can sign up through our online portal via an individual link. Once you have received approval from your employer, you will receive an order code.

Use your order code to select your desired bike from one of our specialist dealers. You can choose any brand and type of bike.

You will sign an agreement for the use of the bike with your employer. The term of this agreement is 36 months. On request and where possible, we will offer you the company bike at the end of the contract period at a reasonable price.

Get on the company bike of your dreams with Lease a Bike! Bike leasing sounds complicated? But it's not! We explain the process to you as an employee in just 60 seconds. For more information, you can download our information pack.

Receive all information about Lease a Bike quickly and easily by e-mail and convince your company.

In the case of salary conversion, the employee receives a portion of the contractually agreed salary not in cash, but as a payment in kind for the period during which the company bike is made available. This means that a change is made by means of a supplementary agreement to the employment contract, in which the employee's future salary is reduced by a fixed amount (conversion rate) for the duration of the transfer of use. This then results in the tax and contribution benefit for the employee. In most cases, the imputed income is also subject to taxation. This is added to the monthly gross salary.

What does this mean exactly?

Gross monthly salary

+ taxation of imputed income

- Conversion rate

- All-round protection costs

= new gross monthly salary

- Taxes

- Taxation of imputed income

= net monthly salary

If you now compare the net monthly salary without the company bike with the net monthly salary with the company bike, you get the monthly costs for the company bike leasing.

Below are some explanations of terms.

Conversion Rate:

The conversion rate is the sum of the leasing rate and the cost of the selected all-round protection package, less any cost coverage by the employer The gross monthly salary is reduced by this conversion rate.

Taxation of the imputed income:

Depending on the form of the transfer by the employer, the use of the company bike is subject to taxation of the non-cash benefit. If a company bike is also provided for unrestricted private use as part of a salary conversion, the non-cash benefit must be taxed. The non-cash benefit from company bike leasing is calculated at a flat rate of 1% of a quarter of the gross list price (RRP) rounded down to a full €100, added to the taxable income and also taxed. This is also referred to colloquially as 0.25% taxation. The amount for the imputed income can be found in the calculation overview in the bike leasing calculator.

With salary conversion, you as an employee do not receive part of your contractually agreed salary in cash, but as a non-cash benefit for the period in which the company bike is provided.

This means that an amendment is made to the employment contract in which your future salary is reduced by a fixed amount (conversion rate) by mutual agreement for the duration of the transfer of use. This then results in a tax and contribution advantage for you as an employee. You can easily calculate your savings in our bike leasing calculator.

Company wheel leasing via salary conversion reduces your monthly gross income and therefore also the social security contributions for your pension. This is often seen as a disadvantage of employee leasing. However, the resulting losses are minimal. With a bike price of 3,000 euros, for example, the future pension entitlement is reduced by around 2 euros per month if the bike is leased with salary conversion over 36 months. Extrapolated, this would be a total of 468 euros less pension for the entire pension entitlement period. This amount is less than the average savings from a company bike. There is also the positive health aspect: according to current studies, regular cyclists are not only fitter and healthier, they also live longer.

If you receive your company bike as a salary supplement, the employer bears the entire cost on top of your salary. As there is no salary conversion in this case, social security contributions are not reduced. The pension is therefore also not affected.

If your continued salary payments are discontinued, our payment default protection comes into effect. This happens, for example, if you are ill for longer than 42 days and receive sick pay or go on parental leave. Lease a Bike will cover the leasing installments for a maximum period of 12 months if the leasing contract has already been running for 6 months. In any case, we will always work together to find the best solution for all parties, unless one of the following options is possible or applies.

These can be:

Change of user. Your employer offers the company bicycle to another employee for the remaining term of the contract. The company takes all necessary internal measures for this (e.g. supplementary agreements to the employment contract, handover of the company bike).

Premature termination of the existing leasing contract by mutual agreement for important economic reasons with possible takeover of the used company bike by you as an employee. You also have the option of financing the purchase price via our FINANCE A BIKE product.

If you change companies, it is possible to transfer the existing leasing contract to a new company. After a credit check, the contract will be continued by the new company with all rights and obligations and the company bike will continue to be provided to you for the remaining term.

Return. If all of the above points do not apply in your case, the bike must be returned to your employer. We will then discuss the details of the individual process with your employer.

The user selects one option each for theft & damage protection (incl. free Europe-wide mobility guarantee), inspection and wear and tear and thus configures the all-round protection package according to their individual requirements. Accordingly, each all-round protection package includes theft and damage protection as well as a budget for inspection and wear and tear.

First of all, a police report is mandatory in the event of theft. With the help of the file number and the household contents insurance data (if available), the report can then be easily submitted by the specialist bike dealer via our portal.

The specialist dealer can access the online form via the “Damage & theft” menu item. You will be automatically redirected to the Allianz portal. One damage report is possible per contract ID.

Using this online form, the claim can simply be submitted digitally. Select the type of claim and answer specific questions for a complete report. Use Google Maps to specify the exact location of the claim. No changes can be made during the entry process. If changes are made, the process must be restarted. Upload all required documents.

After verification by the insurance company, the specialist dealer will receive approval and confirmation that we will cover the costs. The current processing status is displayed during the process.

A selection/coordination with availability of a bike of the same type and quality can be made between the specialist dealer and the user until approval.

The invoicing of the new bike and also the payment is done by us.

The handover of the new bike requires a prior, final approval by us.

Note on object exchange in the event of theft within the existing contract with a bike of the same type and quality. The new bike must only have the same purchase value, including accessories, as the stolen bike.

However, the company bike will only be replaced if the all-inclusive option for theft and damage protection has been selected. If the user only has the premium option, the current value insurance will apply and the leasing contract will be terminated in the event of theft and the bike will not be replaced.

In order to guarantee that the theft report is processed quickly, it will only be submitted by specialist bike shops. If you have any further questions, please contact us.

With my employer's Lease a Bike option, we jumped for joy and then immediately looked for and put together a cargo bike intensively and with a lot of love. It's great to be so flexible and to be able to afford it. Lease a Bike is the best thing that could have happened to us.

Silke Winkler

My special Lease a Bike experience was a telephone contact with your employee in the claims department. She was the proverbial angel and took care of everything. Five stars and an enthusiastic customer who also recommends Lease a Bike because of this experience!

Thomas Diening

I realise that I'm on the right track with Lease a Bike when I regularly cycle past the cars stuck in traffic jams in a good mood.

Christian Hesse

When my company bike was stolen, I quickly found and received a new one as a replacement without any trouble. I have done many good tours with the bike and discovered great new places and beautiful views.

Wolfram Rettinger

Fast and perfect processing. Good services. And above all, lots of fun with the great bike. Always happy to return!

Claudia Wahl

Riding an e-bike is simply a great way to balance out my job in the office. With Lease a Bike, everything went very easily and I'm happy that I have a great e-bike for little money per month that is regularly serviced.

Andrea Lurtz

The terms of the contract are transparent, the order processing was smooth and the order confirmation was very quick. When calling the hotline, very good support and advice, personal contact and direct contact person, quick answer to all questions.

Osman Akay

With up to 40% savings compared to the purchase, the dream bike is within reach. Because with e-bike & bicycle leasing for employees, everyone can get their dream bike quickly, easily and cheaply. With our calculator you can now calculate your monthly rate. In our information package you will find everything you need to know about e-bikes and bicycle leasing.

With over 6,700 dealers, you can easily pick up your bike around the corner. A handy feature for when you need maintenance or repair also.

The term of contracts for company bikes is generally 36 months.

With the Lease a Bike service bike concept, you have a free choice of type and brand. We want you to be able to ride your dream bike. Get an overview of possible company bike leasing models in the Bikefinder or contact a bike shop near you for other bike models.

Your employer determines how many company bikes can be leased per employee. When you log in to the Lease a Bike portal with your access data, you will find information on the maximum number of bikes on the start page. If your employer allows you to lease several company bikes, it doesn't matter who is using the company bike.

You can also lease several company bikes with your existing order code. You can choose a different dealership or a later date. The code is only no longer valid once the maximum number of bikes has been reached.

If more than one company bike can be used privately free of charge or at a reduced price under the employment contract, the pecuniary benefit of providing the company bikes for private use must be calculated for each company bike in accordance with the 1% rule.

Note: In the case of the company bike, the assessment basis for the taxable non-cash benefit is quartered and rounded down to the nearest hundred. This corresponds to 0.25% taxation.

Find out more about the process of bike leasing as an employee.

Lease a Bike has an active network of over 6,000 specialist dealers throughout Germany. You can find specialist dealers near you under the following link. If your desired dealer is not listed, please contact us. Registering a new specialist retailer can be done in just a few steps.

Company bikes with electric motor assistance can be divided into two categories: 1. pedelecs or e-bikes and 2. S-pedelecs. The term "e-bike" is often used as a synonym for pedelec.

With a pedelec (pedal electric cycle), the rider is assisted by an electric drive (max. 250 watts) up to a speed of 25 km/h when pedaling. It is legally considered a bicycle, may be ridden on cycle paths and does not require registration or a driver's license. Helmets are not compulsory.

Use the Bikefinder to find out which company bike is right for you.

The S-pedelec (fast pedelec) as a service bike is functionally comparable to the pedelec, but the rider is supported by the electric motor (max. 500 watts) up to 45 km/h. As an S-Pedelec is classified as a moped, legal requirements apply:

You must ride an S-pedelec on the road unless the cycle path is signposted for motorized two-wheelers, it is outside a built-up area or the motor is switched off.

If an S-pedelec is leased as a company bike via the Lease a Bike concept, for example, the commute (Section 8 (2) EStG) must be taxed at 0.03% of the list price per kilometer.

Your employer can offer company bike leasing as an employee benefit. Lease a Bike enables you as an employee to lease your dream bike quickly and easily. Thanks to deferred compensation, the bike of your choice is paid for monthly via your gross salary and you save on social security contributions and taxes. If you use company bike leasing, you will also benefit, for example, from an improvement in your fitness and health as well as savings of up to 40% compared to purchasing. You also make a contribution to sustainable mobility by switching to a bike. You can find more information here.

Bike leasing through your employer? No problem! With Lease a Bike, anyone can lease their dream bike quickly and easily. Thanks to deferred compensation, the bike of your choice is paid monthly via your gross salary and you can save on social security contributions and taxes.

How to get started with bike leasing and Lease a Bike:

Convince your employer

Do you want a company bike? Talk to your employer first. Our team will be happy to help you.

Registration

Once your employer has successfully registered, you can register via an individual link in our online portal. Once your employer has approved your registration, you will receive an order code for your company bike.

Select a company bike

Use your order code to select your company bike from a specialist retail partner. You can choose any brand and any type of bike.

Get pedaling

You conclude a contract with your employer for the use of the bike. The term is 36 months. If you wish, we can offer you the company bike at the end of the contract period at a reasonable price.

Secure an information package now and convince your employer.

Cycling is good for your health and your wallet. A company bike can be up to 40% cheaper than buying one. Salary conversion reduces your taxable gross salary and therefore also your social security contributions and taxes. You can easily see how much you can save with our calculator.

Here is an overview of the advantages of company bike leasing with Lease a Bike:

Another major advantage of bike leasing is that you can use the bike of your choice for both business and private purposes without any worries. Thanks to your company bike, you can integrate exercise directly into your everyday life, keep fit and make everyday journeys in a climate-friendly way. In addition, you often save time and money, for example in the form of travel costs, by replacing your car with a bike from time to time. A practical and efficient option, especially in the city. Find out more about the benefits here.

In the case of salary conversion, the employee receives a portion of the contractually agreed salary not in cash, but as a payment in kind for the period during which the company bike is made available. This means that a change is made by means of a supplementary agreement to the employment contract, in which the employee's future salary is reduced by a fixed amount (conversion rate) for the duration of the transfer of use. This then results in the tax and contribution benefit for the employee. In most cases, the imputed income is also subject to taxation. This is added to the monthly gross salary.

What does this mean exactly?

Gross monthly salary

+ taxation of imputed income

- Conversion rate

- All-round protection costs

= new gross monthly salary

- Taxes

- Taxation of imputed income

= net monthly salary

If you now compare the net monthly salary without the company bike with the net monthly salary with the company bike, you get the monthly costs for the company bike leasing.

Below are some explanations of terms.

Conversion Rate:

The conversion rate is the sum of the leasing rate and the cost of the selected all-round protection package, less any cost coverage by the employer The gross monthly salary is reduced by this conversion rate.

Taxation of the imputed income:

Depending on the form of the transfer by the employer, the use of the company bike is subject to taxation of the non-cash benefit. If a company bike is also provided for unrestricted private use as part of a salary conversion, the non-cash benefit must be taxed. The non-cash benefit from company bike leasing is calculated at a flat rate of 1% of a quarter of the gross list price (RRP) rounded down to a full €100, added to the taxable income and also taxed. This is also referred to colloquially as 0.25% taxation. The amount for the imputed income can be found in the calculation overview on the calculator page.

The leasing rate shown in the supplementary agreement to the employment contract does not correspond to the actual costs for your company bike.

The leasing rate is shown net and gross. If your employer is entitled to deduct input tax, the net leasing rate is usually offset against your gross monthly salary. This reduces your taxable gross monthly salary. Your taxes and social security contributions are reduced accordingly. If your employer is not entitled to deduct input tax, the gross leasing rate will be deducted from your gross monthly salary.

The conversion rate in the supplementary agreement to the employment contract does not take into account a possible subsidy from the employer.

Would you like to know exactly how much you can save? Then visit our calculator.

With salary conversion, you as an employee do not receive part of your contractually agreed salary in cash, but as a non-cash benefit for the period in which the company bike is provided.

This means that an amendment is made to the employment contract in which your future salary is reduced by a fixed amount (conversion rate) by mutual agreement for the duration of the transfer of use. This then results in a tax and contribution advantage for you as an employee. You can easily calculate your savings in our calculator.

Company wheel leasing via salary conversion reduces your monthly gross income and therefore also the social security contributions for your pension. This is often seen as a disadvantage of employee leasing. However, the resulting losses are minimal. With a bike price of 3,000 euros, for example, the future pension entitlement is reduced by around 2 euros per month if the bike is leased with salary conversion over 36 months. Extrapolated, this would be a total of 468 euros less pension for the entire pension entitlement period. This amount is less than the average savings from a company bike. There is also the positive health aspect: according to current studies, regular cyclists are not only fitter and healthier, they also live longer.

If you receive your company bike as a salary supplement, the employer bears the entire cost on top of your salary. As there is no salary conversion in this case, social security contributions are not reduced. The pension is therefore also not affected.

If your continued salary payments are discontinued, our payment default protection comes into effect. This happens, for example, if you are ill for longer than 42 days and receive sick pay or go on parental leave. Lease a Bike will cover the leasing installments for a maximum period of 12 months if the leasing contract has already been running for 6 months. In any case, we will always work together to find the best solution for all parties, unless one of the following options is possible or applies.

These can be:

Employers can reduce the monthly conversion rate with a voluntary allowance. However, there is no obligation to do so. However, experience shows that participation in company bike leasing among employees increases when employers pay a subsidy.

If you do not wish to purchase the bike, we will conveniently collect it from you or your company.

If your continued salary payments are discontinued, our payment default protection comes into effect. This happens, for example, if you are ill for longer than 42 days and receive sick pay or go on parental leave. Lease a Bike will cover the leasing installments for a maximum period of 12 months if the leasing contract has already been running for 6 months. In any case, we will always work together to find the best solution for all parties, unless one of the following options is possible or applies.

These can be:

If your continued salary payments are discontinued, our payment default protection comes into effect. This happens, for example, if you are ill for longer than 42 days and receive sick pay or go on parental leave. Lease a Bike will cover the leasing installments for a maximum period of 12 months if the leasing contract has already been running for 6 months. In any case, we will always work together to find the best solution for all parties, unless one of the following options is possible or applies.

These can be:

Premature termination of a leasing contract is also possible in certain cases during the agreed contract term of 36 months. Please do not hesitate to contact us.

Yes, you can use your company bike for private purposes.

The user selects one option each for theft & damage protection (incl. free Europe-wide mobility guarantee), inspection and wear and tear and thus configures the all-round protection package according to their individual requirements. Accordingly, each all-round protection package includes theft and damage protection as well as a budget for inspection and wear and tear.

Depending on the inspection option selected, your available budget for inspections per leasing year and the number of possible inspections during the leasing period will vary. The wear and tear budget per leasing year also varies depending on the option selected. The costs for inspections and wear and tear repairs are settled via the budget booked in each case. If the budget is exceeded, you pay the difference. Simply contact one of the Lease a Bike specialist dealers and make an appointment.

Depending on the inspection option selected, your available budget for inspections per leasing year and the number of possible inspections during the leasing period will vary. A maximum of one inspection can be carried out per leasing year. The costs for the inspection and for wear and tear repairs are settled via the budget booked in each case. If the budget is exceeded, you pay the difference. Simply contact one of the Lease a Bike specialist dealers and make an appointment.

The statutory warranty period is two years. After this period has expired, damage, e.g. to the drive or battery on pedelecs/e-bikes, is still covered by our all-round protection during the term of the warranty. Warranty and guarantee claims are always handled directly by the Lease a Bike specialist shop from which the company bike was purchased.

Every Lease a Bike service bike receives an all-round protection package with an individually selected annual wear and tear budget upon conclusion of the contract. We use this budget to cover all necessary repairs to restore operational safety as well as wear-related repairs. This includes the following wear parts, among others:

Firstly, a police report is mandatory in the event of theft. Using the file number and the household contents insurance details (if available), the report can then be easily submitted by the bike dealer via our portal.

Note on object exchange in the event of theft within the existing contract with a bike of the same type and quality. The new bike must only have the same purchase value, including accessories, as the stolen bike.

However, the company bike will only be replaced if the all-inclusive option for theft and damage protection has been selected. If the user only has the premium option, the current value insurance will apply and the leasing contract will be terminated in the event of theft and the bike will not be replaced.

In order to guarantee that the theft report is processed quickly, it will only be submitted by specialist bike shops. If you have any further questions, please contact us.

The damage report is simply submitted via the specialist dealer.

Our theft & damage cover includes all sudden and unforeseeable damage or destruction to the leased object, e.g. due to:

Please note which theft and damage protection option the user has chosen: If the user has selected the all-inclusive option for theft and damage protection as part of the all-round cover, the new value insurance applies. The Lease a Bike company bike is then insured against theft around the clock if the company bike was locked. It will be replaced at replacement value and an object exchange will be made in the existing contract. As a rule, it is not necessary to terminate the existing contract.

If the user has selected the premium option for theft and damage protection as part of the all-round cover, the current value insurance comes into effect. The Lease a Bike company bike is then insured against theft around the clock if the company bike was locked. However, the leasing contract is then terminated and the bike is not replaced.

Free Europe-wide mobility guarantee including 24/7 roadside assistance

In the event of a claim, we provide the following services from a distance of 10km from the permanent residence to maintain mobility:

You can reach our breakdown service on 04471 967 3113. You can find further contact details here.

The company bike and company car can also be used at the same time. The 1% method then applies to both the company bike and the car.

In contrast to the company car, employees do not have to pay tax of 0.03 percent per kilometer for the journey to work.

Electric bicycles with a motor that provides assistance at more than 25 km per hour are classified as motor vehicles under traffic law and the non-cash benefit is assessed in the same way as for a company car.

Note: In the case of a company bike, the assessment basis for the taxable non-cash benefit is quartered and rounded down to the nearest hundred. This corresponds to 0.25% taxation.

The commuting allowance for journeys between home and work is generally to be granted at € 0.30/km regardless of the means of transportation (Section 9 (1) No. 4 EstG).